Here’s a fun fact about the boring middle: You can make it a lot more exciting by doing stupid things!

In the past few years I’ve had the kind of frustration that everyone wants. I pay an absurd amount of taxes. Anyone that’s a high earning W2 worker will tell you, it’s not fun to have 37% of your paycheck taken every pay period and then be told at the end of the year that you still owe a five figure tax bill. If you are blessed to have stock options or RSU’s as part of your pay, you feel this acutely when you see half your stock taken to pay estimated taxes, and then they try to tax you again on the same thing.

For most single people or couples who are both W2 workers, there wont be a lot of places where you can reclaim your tax money. In 2023 the standard deduction for single workers was $13,850, for married filing jointly it was $27,700 and for head of household it was $20,800. For the majority of people, this is going to be your whole tax deduction.

If you are slightly more complicated and own a home or two (and aren’t crushed by the SALT tax cap) and have a side hustle that earns you some 1099 income, or maybe you’re an independent contractor or business owner, you have some wiggle room to itemize your tax deductions. In my personal situation, I have had about eight years of 1099 income from Amazon for affiliate marketing through my profitable website. Not this website, nobody reads this one, but that site generally pulls in a few thousand a year allowing me to pull in a few extra write-offs. This helped absorb the write-offs we lost when my wife became a stay at home mom, giving up her own 1099 job. But it isn’t much.

Then there’s the standard tax avoidance strategies. Max out the Roth, IRA, HSA and 401k contributions if you can. If it’s available you can contribute to a differed compensation plan, pushing income out to a time when maybe you’re on sabbatical or taking a mini-retirement (we should all be so lucky). Traditional Roth accounts are likely unavailable to high income workers. If you have a young family, I really don’t recommend a high deductible health plan, but if you’re willing to roll the dice on that you can get access to an HSA. High earners also wont get any benefit from contributing to an IRA other than tying their money up in an inaccessible account for many years. Maxing out a 401k can effectively double the standard deduction. And contributing to 529s for kids could also offer a modest tax benefit but likely won’t move the needle.

So what’s a high earning W2 worker to do to LEGALLY avoid taxes when all other avenues are exhausted? This is the question that’s been frustrating me and I’m sure many other people for years. In my case, working on the advice of absolutely no financial professionals, I decided to spin up an LLC and transfer ownership of my affiliate blog to it.

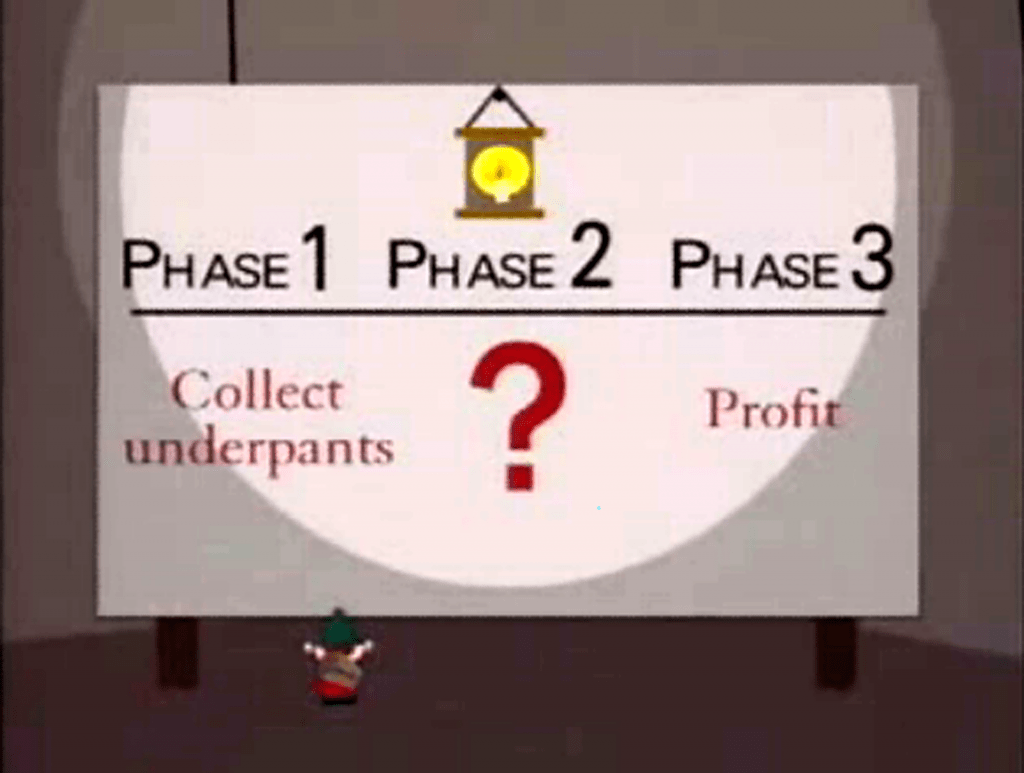

My plan looked something like this:

With the help of ZenBusiness and the judicious application of around $700, my LLC was up and running in no time. The transfer of my blog to my LLC was accomplished by writing a simple letter declaring that I was doing exactly that and filing it with my LLC documentation. And then I was ready for profit!

Once I had my LLC and profitable website linked together, I simply waited for tax season for the write-offs to roll in. Only they didn’t. In fact, when I showed my fancy new business to my accountant he told me to kill the business.

As it turns out, my 1099 earnings have been serving as a way to get write-offs through a Schedule-C filing, which they’ve been doing for me for years. Creating the LLC created a new tax entity. One that would need its own taxes filed as a business. Something that was going to cost me about as much as the LLC to file each year. Plus I had to pay ZenBusiness a couple hundred dollars a year to manage the various business functions I still don’t know much about.

Four short months after my company was born I paid $120 to have it dissolved. The one saving grace is that I was able to submit a chunk of my business startup costs as a write-off in themselves, but I got back only a couple hundred dollars.

What did I learn from this? First, I learned to consult my finance professional BEFORE I made any moves. They could have told me that it was a poor idea from the start. Second, I learned that if I really want to start a business, I should focus on the business itself. Things like building a client or subscriber base and increasing my earned income should come long before I think about creating an LLC. And third, that even though I got where I am by doing things that most people wouldn’t do, sometimes there’s a reason people aren’t doing a thing. If owning an LLC was an easy tax shelter for high earning W2 workers, most high earning W2 workers would be doing it.

Some day I hope to spin up a side business for all the right reasons, rather than just to dodge taxes. Right now, I just don’t have the energy to dedicate to that. In the future, when I don’t have as many competing priorities I’m going to revisit this, but for now, I will have to come up with another strategy.