Personal finance guru’s love to talk about your emergency fund. There are varying amounts of money that they suggest you should sock away in case of an emergency. I am not taking a contrarian stance on this because I wholeheartedly agree, but….

I am old enough to have had a number of true emergencies. I’ve run out of oil in the middle of the night, I’ve had to bail a friend out of jail, I’ve had to live on Long Island for longer than a week with no power or gasoline. All of those situations had one thing in common: I needed cash in hand to get out of an emergency.

You’ll hear many opinions about how much money you should set aside for an emergency. Most agree that you should have at least $1,000 in the bank to handle emergencies like a car accident, home repair, or other emergency when you can settle the bill at your leisure. This is an easy fund to set aside and manage even for those with little income. It gives a minor feeling of security, and lets you know that if a little emergency happens, you’ve got it covered.

Then there’s the big emergency fund. This is the fund you should have set aside in case you lose your job, your house burns down, Nazi’s have kidnapped your grandma…this is usually recommended to be three to six months worth of bills. This is tough for many people to do. Setting aside a quarter to half of a year’s bills takes most people a long time to do. Plus, that’s hard earned cash, a lot of it, sitting in an account for a rainy day. There are many opinions about what to do with this money, as it could be a substantial amount. Some recommend keeping it fully liquid in a savings or money market account. Others recommend something semi-liquid like a Roth IRA, stocks, bonds or CD’s. This is a good way to keep your emergency fund working for you while it’s just sitting there. Overall it’s a good idea to keep the money in a relatively stable place and not put your emergency fund in penny stocks.

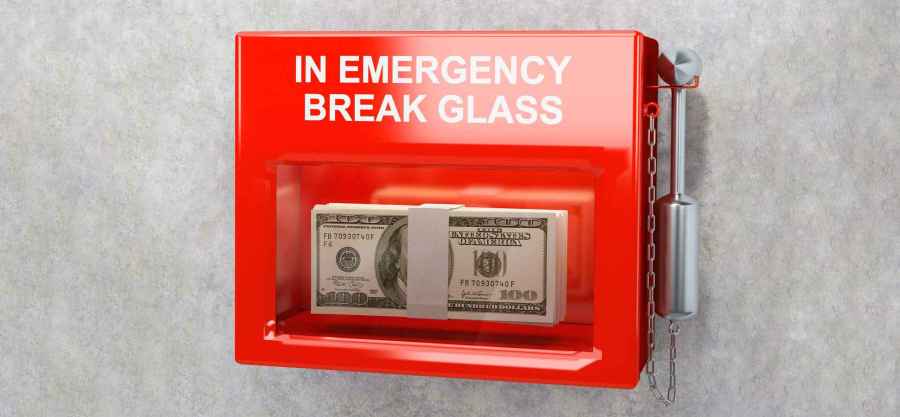

In my experience there is one more emergency fund that you should have, and that’s what I call a TRUE emergency fund. I recommend $300-$1000 in cash. This doesn’t have to be on your person at all times, but having this money in your home protects you from times where money may not be readily available and credit cards are out of the question. I know this conjures up images of shady situations, but believe me I’ve found myself in plenty of situations where having a few hundred dollars around either fixed the situation or saved me a bunch of money by paying in cash.

The aforementioned oil emergency happened during a lengthy cold snap in New York, and not only did I need a delivery first thing in the morning, I had to bribe the guy to come. This meant I not only needed over $400 in cash at six AM on a Sunday, I also needed $50 to tip the guy for waking up and keeping my family from freezing.

I’ve also dipped into the fund when an opportunity has come my way that can only be met with cash. Occasionally I’ve had people do a job or at the house, and when presenting the bill they’ve said “Listen, I can knock fifty dollars off if you pay cash.” This is a no brainer for me, and I’m happy to do it.

“But John”, you may say, “we have ATM’s for this sort of thing!” Unless your bank is special, there’s a daily limit on ATM transactions and it’s usually somewhere between $300 and $500. And in the event of a lengthy power outage, like the wake of a natural disaster, you’ll be driving a long way to find an ATM.

The toughest thing I’ve found about maintaining the true emergency fund is not using it as your own ATM. It’s easy to just grab $20 on your way out to the bar, but just as easy to forget to replenish the fund. I recommend keeping only $100 in small bills, the rest should be $100’s so they’re harder to spend. I also recommend putting the fund in an out of the way place, where it might be a pain to get at the money on a day to day basis. If you do take money from the fund, you should make a note to put it back, and put said note in a conspicuous place so you actually do it.

One thought on “A True Emergency Fund”